For latest course notes, free audio & video lectures, support and forums please visit

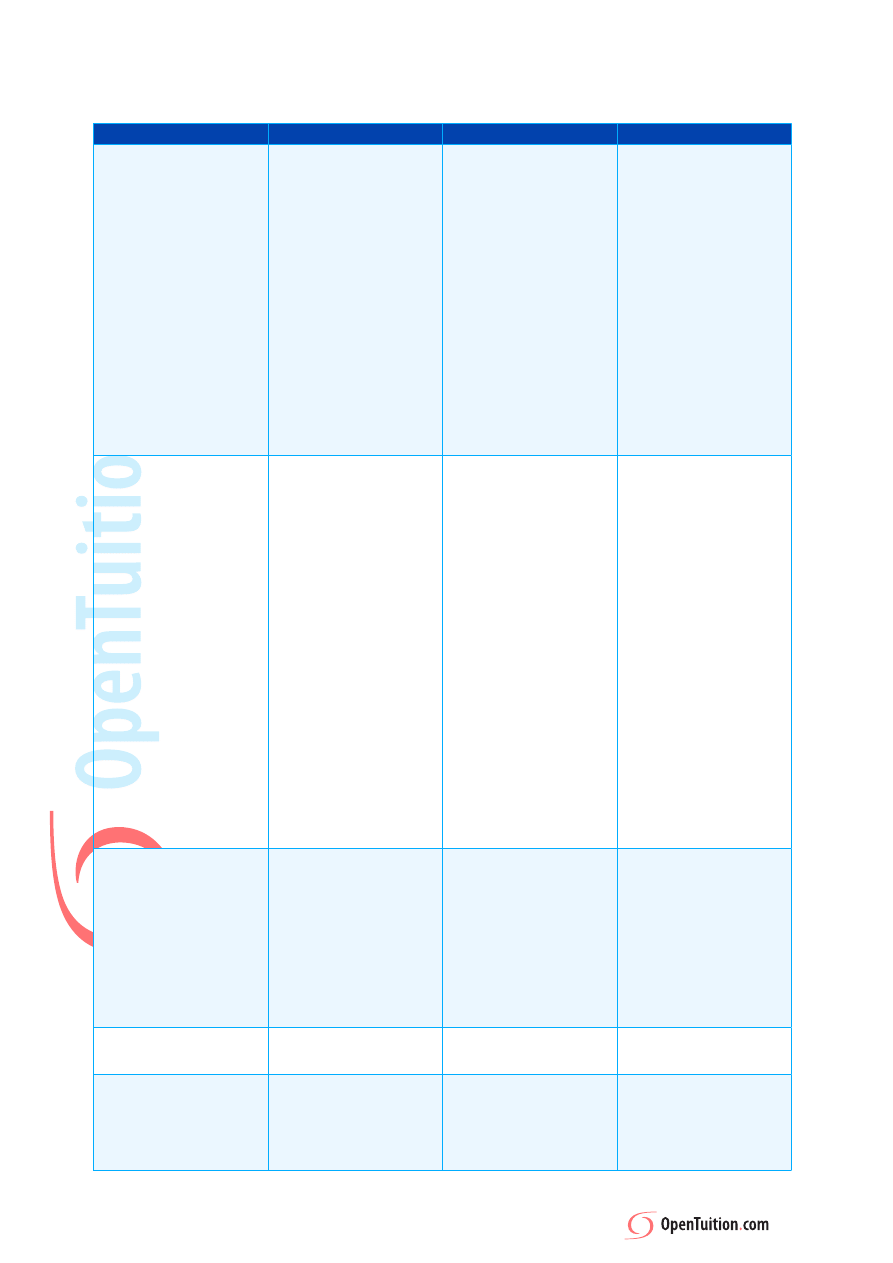

SELF ASSESSMENT-INDIVIDUALS

FACTOR

DUE DATE

COMMENTS

PENALTIES

NOTIFICATION OF TAXABLE

SOURCE OF INCOME

5 OCTOBER FOLLOWING THE

END OF THE TAX YEAR THE

SOURCE AROSE

THE LEVEL OF PENALTY IS A %

OF THE TAX UNPAID 12

MONTHS AFTER THE END OF

THE ACCOUNTING PERIOD

AND DEPENDS ON THE

BEHAVIOUR OF THE TAXPAYER

GENUINE MISTAKE=NO

PENALTY

FAILURE TO TAKE REASONABLE

CARE=30%

SERIOUS OR DELIBERATE

UNDERSTATEMENT=70%

SERIOUS OR DELIBERATE

UNDERSTATEMENT WITH

CONCEALMENT=100%

PENALTIES CAN BE REDUCED

WHERE THE TAXPAYER MAKES

FULL DISCLOSURE AND

COOPERATES WITH HMRC TO

ESTABLISH THE AMOUNT OF

UNPAID TAX

TAX RETURNS

THE TAXPAYER HAS THE

CHOICE OF FILING A PAPER

RETURN OR FILING

ELECTRONICALLY ONLINE.

ALL COMPLETED AND SIGNED

PAPER RETURNS MUST BE

FILED BY THE LATER OF:

31 OCTOBER FOLLOWING

THE END OF THE TAX YEAR

OR 3 MONTHS AFTER THE

RETURN IS ISSUED. THIS IS

ALSO THE DEADLINE IF THE

TAXPAYER WISHES HMRC TO

CALCULATE THE TAX ON

THEIR BEHALF.

ALL ONLINE ELECTRONIC

RETURNS MUST BE FILED BY

THE LATER OF:

31 JANUARY FOLLOWING

THE END OF THE TAX YEAR

OR 3 MONTHS AFTER THE

RETURN IS ISSUED

FOR 2009/10:

31 OCTOBER 2010 FOR PAPER

RETURNS

31 JANUARY 2011 FOR

ELECTRONIC RETURNS

THE 31 JANUARY

FOLLOWING THE END OF

THE TAX YEAR IS KNOW AS

THE “FILING DATE”

REGARDLESS OF WHETHER

THE RETURN IS FILED ON

PAPER OR ELECTRONICALLY.

THIS MUST BE

DISTINGUISHED FROM THE

DATE ON WHICH THE

RETURN IS FILED (KNOWN

AS THE “ACTUAL FILING

DATE”)

0-6 MONTHS=£100

6-12 MONTHS £200

>12 MONTHS TAX GEARED

PENALTY

DAILY PENALTY OF £60 MAY BE

IMPOSED UPON DIRECTION BY

THE TRIBUNAL

PAYMENT DATES

TWO PAYMENTS ON

ACCOUNT=31 JANUARY IN THE

TAX YEAR AND 31 JULY

FOLLOWING THE END OF THE

TAX YEAR

BALANCING PAYMENT 31

JANUARY FOLLOWING THE

END OF THE TAX YEAR (FILING

DATE)

PAYMENTS ON ACCOUNT ARE

BASED ON PREVIOUS YEARS

TAX PAYABLE BY SELF

ASSESSMENT

INTEREST FOR ANY LATE

PAYMENTS

A SURCHARGE IF THE

BALANCING PAYMENT IS LATE:

0-28 DAYS= 5% OF THE LATE

TAX

>6MONTHS AN ADDITIONAL

5%

CLAIMS

INCLUDED IN THE TAX RETURN

OR SEPARATE CLAIM IN

WRITING

CLAIM QUANTIFIED

CLAIMS TO REDUCE

PAYMENTS ON ACCOUNT

BY 31 JANUARY FOLLOWING

THE END OF THE TAX YEAR

PENALTY FOR INCORRECT

CLAIM IS THE DIFFERENCE

BETWEEN THE AMOUNTS

ACTUALLY PAID AND

AMOUNTS THAT SHOULD

HAVE BEEN PAID

For latest course notes, free audio & video lectures, support and forums please visit

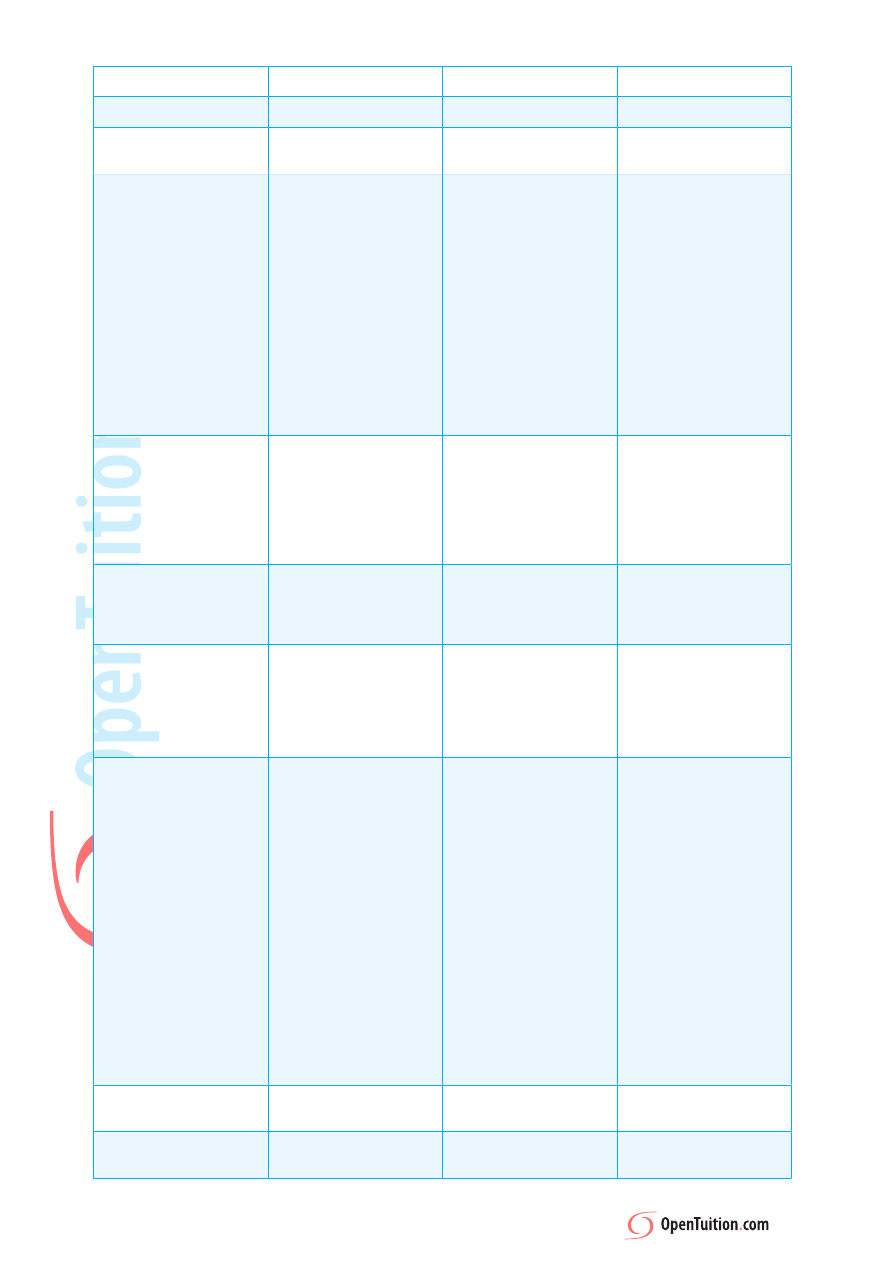

HMRC AMENDMENTS TO

RETURN

9 MONTHS FROM DATE

RETURN IS SUBMITTED

TAXPAYER AMENDMENTS TO

RETURN

12 MONTHS FROM FILING

DATE

ERROR OR MISTAKE CLAIM WITHIN 4 YEARS FROM THE

END OF THE TAX YEAR

CONCERNED

RECORDS KEPT

SELF EMPLOYED AND RENTAL

BUSINESS= FIVE YEARS FROM

THE FILING DATE OF THE TAX

YEAR CONCERNED

OTHER INDIVIDUALS= 1 YEAR

FROM THE FILING DATE OF THE

TAX YEAR CONCERNED

UP TO £3000 PER YEAR OF

ASSESSMENT

HMRC ENQUIRIES

12 MONTHS FROM THE

ACTUAL FILING DATE OF THE

TAX YEAR CONCERNED

DEADLINE IS EXTENDED IF A

RETURN IS FILED LATE( AFTER

31 JANUARY) OR AMENDED IE

12 MONTHS FROM THE END

OF THE RELEVANT QUARTER IN

WHICH THE RETURN IS

SUBMITTED OR AMENDMENT

MADE

HMRC DETERMINATIONS

3 YEARS FROM THE SELF

ASSESSMENT FILING DATE

A DETERMINATION CANNOT

BE APPEALED AGAINST THEY

CAN ONLY BE REDUCED BY AN

ACTUAL SUBMISSION OF THE

TAX RETURN

HMRC DISCOVERY

ASSESSMENTS

4 YEARS FROM THE END OF

THE TAX YEAR CONCERNED, 6

YEARS IF THERE IS A CARELESS

ERROR AND 20 YEARS IF THERE

IS A DELIBERATE ERROR OR

FAILURE TO NOTIFY

CHARGEABILITY TO TAX

PENALTIES FOR INCORRECT

RETURNS

THE LEVEL OF PENALTY IS A %

OF THE REVENUE LOST AS A

RESULT OF THE INACCURACY

OR UNDER ASSESSMENT AND

DEPENDS ON THE BEHAVIOUR

OF THE TAXPAYER

GENUINE MISTAKE=NO

PENALTY

FAILURE TO TAKE REASONABLE

CARE=30%

SERIOUS OR DELIBERATE

UNDERSTATEMENT=70%

SERIOUS OR DELIBERATE

UNDERSTATEMENT WITH

CONCEALMENT=100%

PENALTIES CAN BE REDUCED

WHERE THE TAXPAYER MAKES

FULL DISCLOSURE AND

COOPERATES WITH HMRC TO

ESTABLISH THE AMOUNT OF

UNPAID TAX

PAYE

19

TH

OF THE MONTH

INCLUDES NIC

AVG MONTHLY PAYMENTS ARE

<£1500 QUARTLEY PAYMENTS

CAN BE MADE

CAPITAL GAINS TAX

31 JANUARY FOLLOWING THE

END OF THE TAX YEAR OF

DISPOSAL

NO PAYMENTS ON ACCOUNT

INCLUDE DETAILS IN SELF

ASSESSMENT TAX RETURN

INTEREST ON LATE PAYMENTS

AND SURCHARGES

Wyszukiwarka

Podobne podstrony:

SELF ASSESSMENT SHEET

10 ?ldrige Self Assessment Sample Rev 1 1 03

self assessment sheet

BilSE self assessment pl

Changes in Negative Affect Following Pain (vs Nonpainful) Stimulation in Individuals With and Withou

Revealing the Form and Function of Self Injurious Thoughts and Behaviours A Real Time Ecological As

Assessment of cytotoxicity exerted by leaf extracts

Take Assessmen 8

Take Assessmen6

AssessingChildrenInNeed

mb star c3 self test manual

bdo assessment iqwig

Molecular Self Assembly

Assessment report

Song of Myself Individuality and Free Verse

F6

Build Self Confidence

75 1067 1073 Elimination of Lubricants in Industries in Using Self Lubricating Wear Resistant

więcej podobnych podstron