The Timken Company

Paulina Adamczyk, Soňa Markechová, Diego Escobar Fraile,

Katarzyna Pietr, Sylwia Przepłata

Agenda

The Bearing Industry

Timken & Torrington

WhyTimken wantedTorrington?

What is the stand-alone valuation of Torrington?

Should Timken be concerned about losing its investment-

grade rating?

How do Timken’s financial ratios compare with those of

other industrial firms in 2002?

HowTimken structured the deal?

What was the with-synergies valuation of Timken/

Torrington?

The Bearing Industry

2001: 33.000 workers in US factories

variety of complex problems

difficult situation on the market

major players: Timken, SKF, NSK

Timken

One of top three players in the Bearing Industry, founded in

1899 in the US

WW II – increased demand and growth of the company

Since 1960s - international expansion

Since 1999- restructuring towards global business units

(2002)

Products: mainly bearings of several types and related

products

Timken - 3 Business Units

Automotive Group – products for Original-Equipment

Manufacturers of cars and trucks

Industrial Group – products for OEMs and distributors of

agricultural, mining, aerospace, and rail equipment

Steel Group – design, manufacture and distribution of alloys

and custom-made steel products for both automotive and

industrial clients

Assets worth $2.75 bn (2002) and net income $38.7bn

(2002) operations in 25 countries and 18,000 workers

The Torrington Company

1960s - acquired by Ingersoll Rand as part of a larger acquisition

process

The Engineered Solutions segement of Ingersoll-Rand

Products: bearings and other diverse metal products such as shafts,

screws

IR decided to divest Torrington Co. in 2002 and focus on

higher return service businesses

Accounted for 22% of income in 2002, revenues $1.2bn (2002)

2 Segments:

Automotive

Industrial

Timken’s Motives for Acquiring

Torrington

Increase market share in the global bearing market

Successful acquisition = being the 3

rd

largest producer of

bearings with many complementary products

Global market share increase to 11%

Create more value for customers

Purchasing synergies

Economies of scale

Cost reductions

However: integration cost ~$130 million

How does Torrington fit with The Timken

Company? 1/2

In 2002, Timken was involved in a company-wide

restructuring (to reduce costs and to set the stage for

international growth) and also was planning to add new

products to its portfolio. “Bundling”

Two companies shared many of the same customers (a

80% overlap) but had few products in common (only a

5% overlap in their product offerings). Timken would

expand its portfolio of products and service solutions

and broaden its technology and engineering capabilities.

How does Torrington fit with The Timken

Company? 2/2

Timken estimated to save more than $80 million in

consolidating manufacturing facilities and processes

(consolidating purchasing activities and distribution

channels, combining operations and eliminating

redundancies within the organization).

- The acquisition would let Timken become a worldwide

leader in bearing industry (third-largest producer of

bearing in the world). Increasing its penetration of the

global bearing market from 7% to 11%.

What are the expected synergies? 1/2

Torrington had sophisticated needle-bearing solutions

for automotive power-train applications, which

complemented Timken´s existing portfolio of tapered

roller bearing and precision-steel components for wheel

ends and drivelines.

Timken´s cylindrical bearings could be married with

flap-like parts from Torrington that lubricated moving

pieces.

Deliver Torrington products under the well-known

Timken brand name would increase its range of products

for aftermarket customers. Using for that the Timken´s

international distribution network. Create more value

for customers with a more complete product line and

more effective new product development

Being number three in the industry would help give

Timken more clout in negotiations with customers and

suppliers.

What are the expected synergies? 2/2

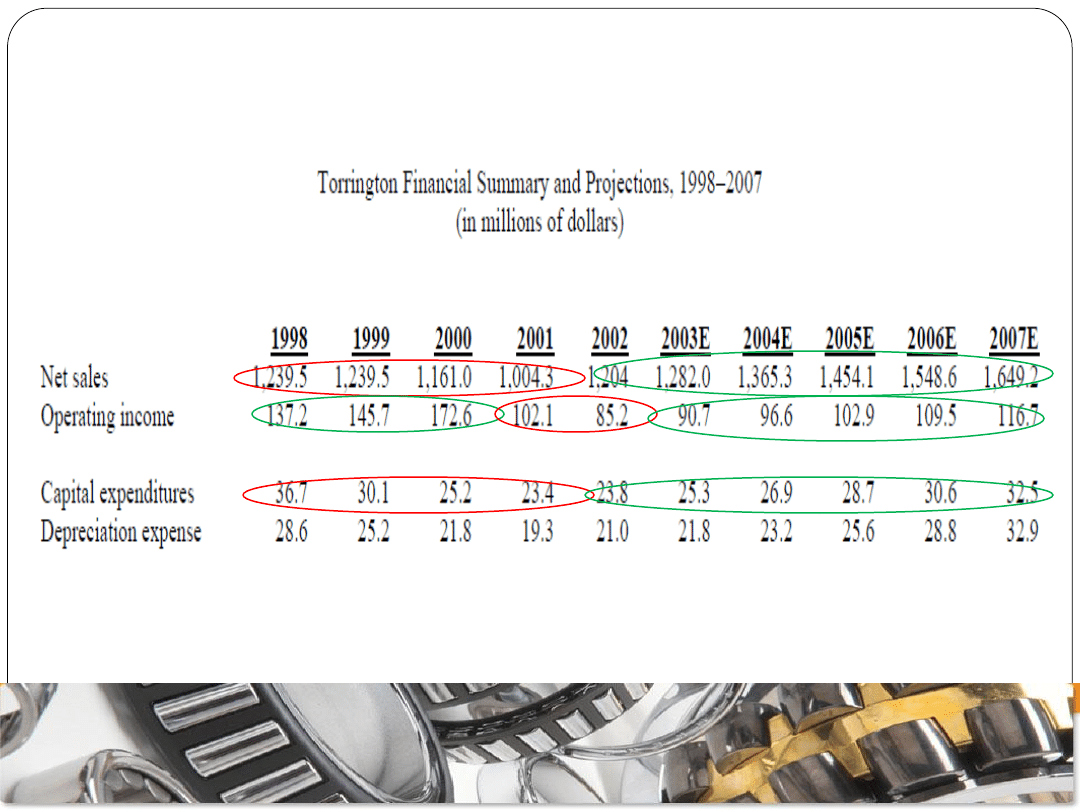

What is the stand-alone valuation of Torrington?

0

200

400

600

800

1000

1200

1400

1600

1800

1998

1999

2000

2001

2002

2003E

2004E

2005E

2006E

2007E

net sales

net sales

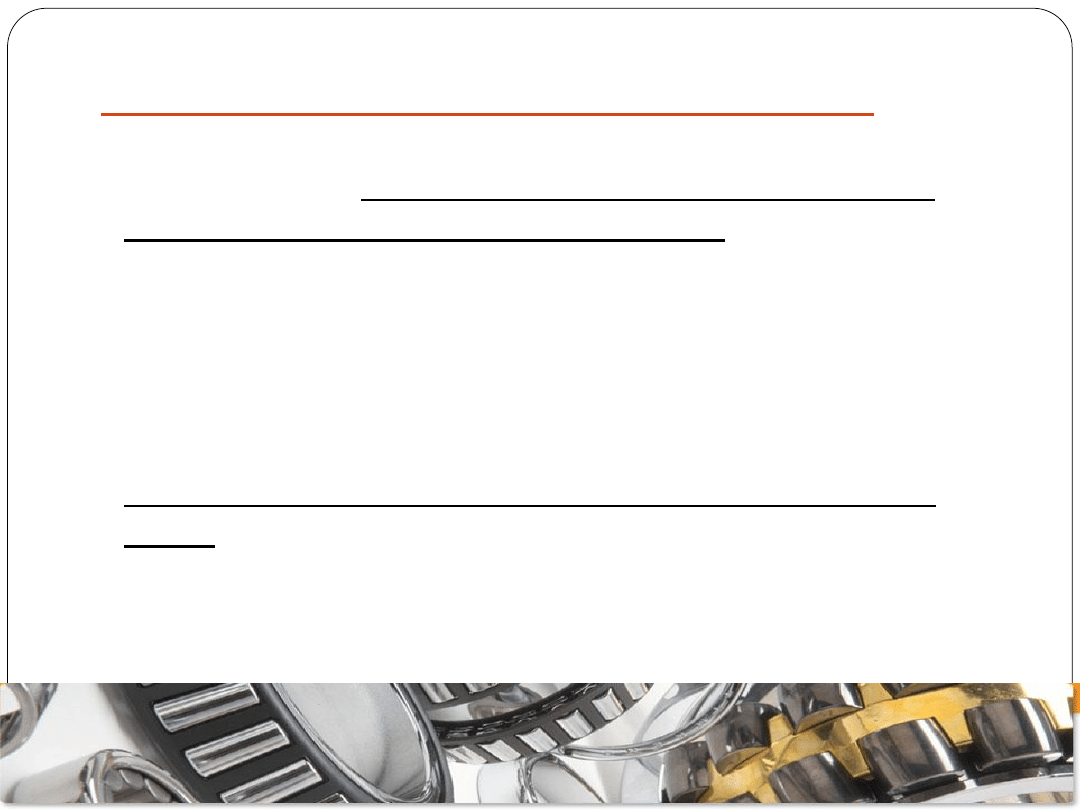

Torrington Financial Summary and Projections

(in millions of USD)

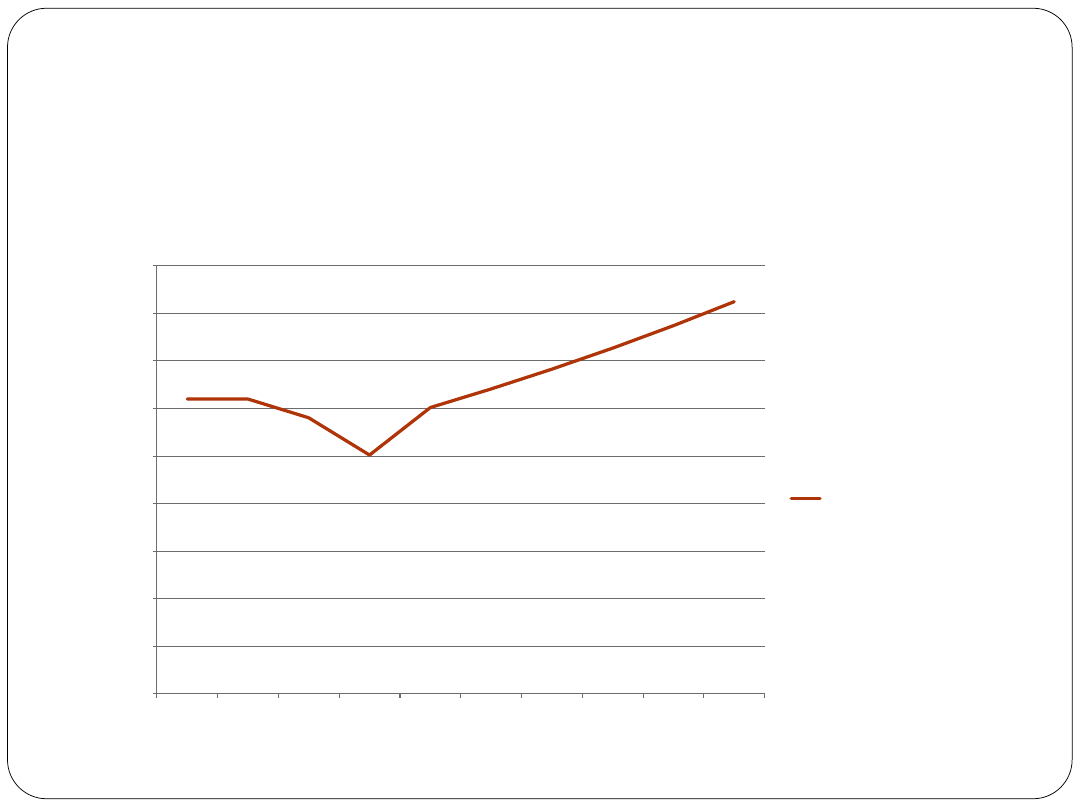

Torrington Financial Summary and Projections

(in millions of USD)

0

20

40

60

80

100

120

140

160

180

200

1998

1999

2000

2001

2002

2003E

2004E

2005E

2006E

2007E

operating income

capital expenditures

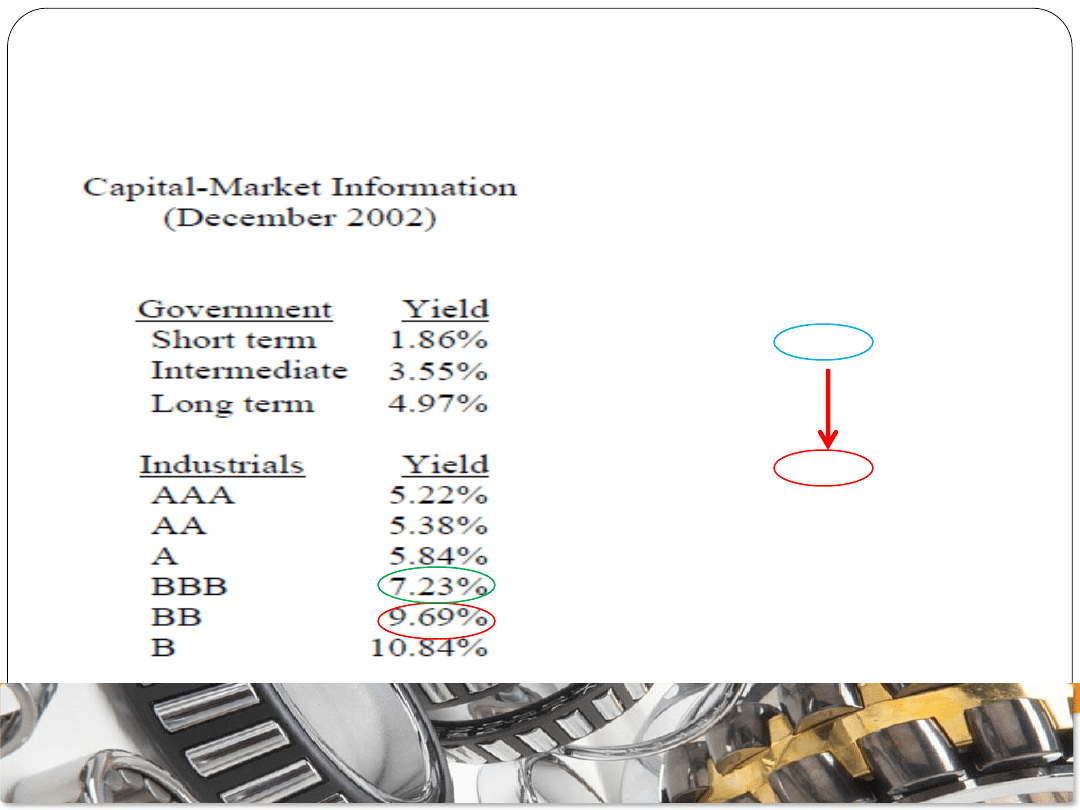

Should Timken be concerned about losing its

investment grade rating?

Timken’s Debt-to-Capital Ratio

1995: 20.5 %

2002: 43.1%

Kaydon Corp.

21.51%

9.09%

11.3

1.25

72.4

NN, Inc.

14.54%

2.61%

7.5

0.85

53.1

Timken

10.81%

2.02%

5.2

1.10

373.9

Commercial Metals

5.66%

1.66%

5.5

0.63

255.6

Melats USA, Inc.

0.42%

5.17%

-

0.38

128.7

Mueller Industires

12.97%

7.45%

7.3

1.08

18.2

Precision Castparts Corp.

18.40%

7.53%

4.5

1.10

612.4

Quantex Corp.

12.77%

5.58%

5.1

0.75

75.6

Worthing Ind.

8.47%

3.39%

10.1

0.49

290.9

-

-

-

-

1173.9

Enterprise

Value/

EBITDA

Debt

(in $ mil.)

Timken

Gross

Margin

Profit

Margin

Bearing Companies

Beta

How do Timken’s financial ratios compare

with other industrial firms in 2002?

How would it change if

Timken borrowed $800 mil.

to buy Torrington?

If Timken decides to go forward with the acquisition, how

should Timken offer to structure the deal?

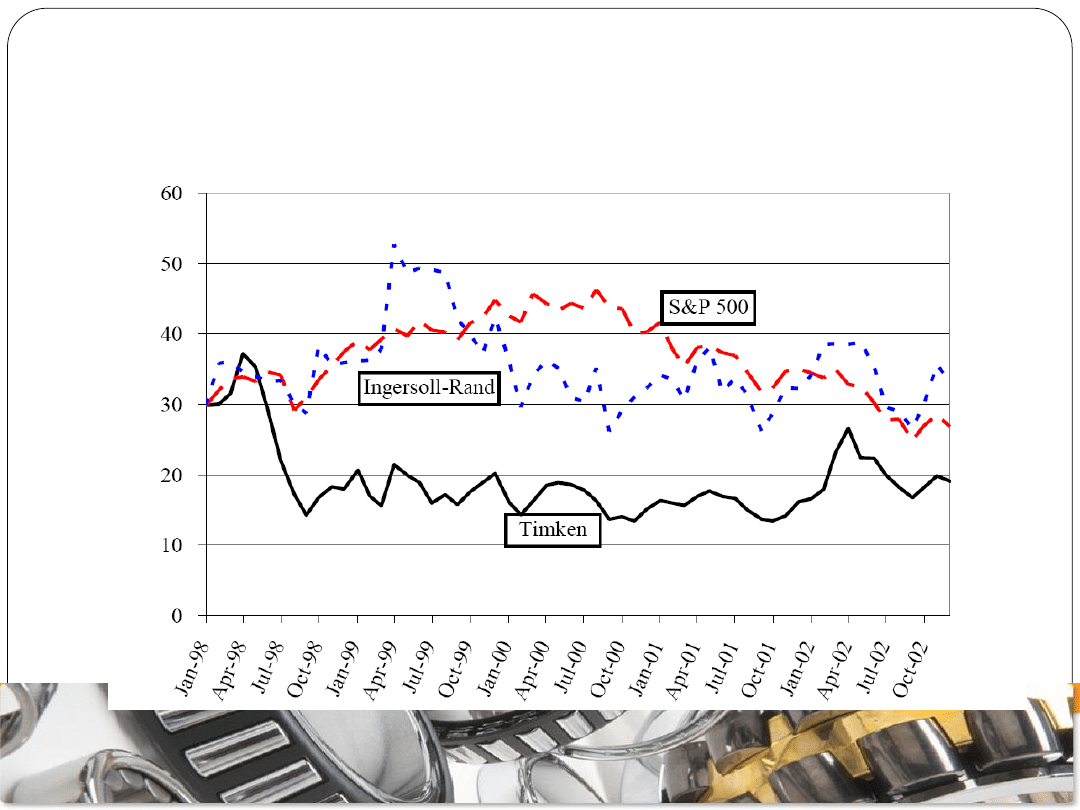

Is Ingersoll-Rand likely to want a cash deal or a stock-for-

stock deal?

What are the risks for Ingersoll-Rand of accepting Timken

shares for some or all of the consideration?

Timken, Ingersoll-Rand, and S&P 500 Stock Performance

Indexed to Timken´s January 1998 Price

(1998-2002)

Feb 20, 2003

The Timken Company completed its

acquisition of The Torrington Company

Timken acquired Torrington from

Ingersoll-Rand for $840 million

$700 million

in cash

•

a public offering of 12.65

millionTimken shares

•

an offering of $250 million

seven-year senior unsecured

notes

•

a five-year revolving credit

facility

•

a $125 million securitized

accounts receivable facility

Timken shares

$140 million =

= 9.4 million Timken shares

= 11% holding in TheTimken

Company

$140 million

The business goes on...

October 20, 2003

Ingersoll-Rand Company Limited has

agreed to sell all of the common

stock it holds in The Timken

Company.

What is the with-synergies

valuation of Torrington/ Timken?

Becoming one of the global leaders in the bearing

industry

Cost savings

Increasing shareholders’ wealth, liquidity, and global

reach

Expanding know-how

Laying off employees

Increasing debt

Restructuring

Thank you for your attention!

Wyszukiwarka

Podobne podstrony:

Financial Analysis of the Company final notes

08 The Functional Lines

The Relationships?tween Semiotics and The Quaker Company

2010 exams dates for individuals ilec icfe toles tkt pl gb 08 02 10 ar final 2

Adams, Robert Horseclans 08 The Death of A Legend

Anderson Poul Flandry 08 The Rebel Worlds

08 The landladys cousin

PN Elrod [Vampire Files 08] The Dark Sleep v1 1 (BD)

Unfortunate Events 08 The Hostile Hospi Lemony Snicket

Isobel Bird [Circle Of Three 08] The Five Paths

Leslie Charteris The Saint 08 The Saint vs Scotland Yard

Scarlet Hyacinth Mate or Meal 08 The Seahorse Who Loved the Wrong Lynx

Alex Archer Rogue Angel 08 The Secret of The Slaves

08 The Unforgiven Metallica

Bujold, Lois McMaster Vorkosigan 08 The Borders of Infinity

Harry Turtledove Videssos Cycle 08 The Stolen Throne

więcej podobnych podstron