57

1- Accounting Convention

Financial statements of the Bank have been prepared under historical cost conven-

tion and current values have also been applied when necessary.

2- Basis for determining Depositors’ Profit Share from Joint Income

By virtue of the usury-free banking Act and its executive directives, and with due

regard to the directives number 1799 dated 08.01.2004 of the Central Bank of the

Islamic Republic of Iran, the profits derived from granting facilities, investment in stock,

participation bonds and inter-bank profit that is recognized according to the prevailing

accounting convention, is considered as joint income and the depositors’ profit share

will be determined in proportion to investing their net resources in granted facilities.

3- Summary of Significant Accounting Policies

3-1- Investments

3-1-1 Evaluation Method

Long-lived assets are evaluated based on cost price less the provisioning for impair-

ment loss of each.

Liquid current assets are evaluated at the least cost price and net market of all

assets, and other current assets are evaluated at their least cost price and net market

of each asset.

3-1-2 Income Recognition Method

Profit from investment in the subsidiaries and affiliated companies are recognized at

the date of approval of their financial statements by the general meeting of sharehold-

ers (till the date of approval of the financial statements of the bank)

Profit from investment in the other companies, current or long term, are

Recognized at the date of approval of their financial statements by the general meeting

of shareholders (till the balance sheet date)

3-2- Tangible Fixed Assets

3-2-1 Tangible Fixed Assets, except the one indicated in 4-2-2 below, are posted based

on cost price. The repairs and improvements leading to considerable increase in the capacity

or estimated useful life of the fixed assets or essentially improve their utility are charged as

capital expenses and depreciated during the remaining useful life of the underlying asset.

Maintenance expenses incurred in partial repairing and retaining economic interests of the

business unit as per initially evaluated performance standards, are considered as current

expenses and carried to the profit (loss) of the period under report.

3-2-2 By virtue of article 62 of the third five-year development plan, the premises

of the bank were revaluated and registered in the books for the amount of 11,543

billion Rial and the resulted surplus, i.e. 10,637 billion Rial, has been added to the

capital increase account of the government in the bank.

Notes to the Financial Statements

58

Declining

Declining

Direct line

Direct line

3-2-3- According to the resolution adopted in 1077

th

session of the Money & Credit

Council on 17.02.2007, depreciation of fixed assets are recorded as per depreciation

chart of article 151 of direct taxes law based on the following rates and depreciation

methods:

According to the note 10 of the code of conduct for depreciation, based on article

151 of direct taxes law, depreciation rate for the buildings revaluated at the end of

1383(2004/05)has been charged at 3.5% using declining method.

3-3- Good Will

By virtue of article 62 of the third five-year development plan, good will of the

business units of the bank were registered in the books based on the revaluated prices

in 1383(2004/05). According to the resolution adopted in 1077

th

session of the Money

& Credit Council depreciation of fixed assets are recorded as per depreciation chart of

article 151 of direct taxes law. So, no depreciation has been calculated for the good will

since beginning of 1385(2006/07).

3-4- Income Recognition

All incomes of the Bank are recognized based on accrual assumption basis and

reflected in the financial statements.

3-5- Foreign Currency Translation

3-5-1- domestic Accounts

Foreign currency monetary items are translated in the market rate (in accordance

with the daily inter-bank reference rate announced by the Central Bank) and foreign

currency non-monetary items are translated in the market rate on translation date.

3-5-2- Foreign branches and subsidiaries

All foreign currency monetary and non-monetary items (except shareholders’

equity) of the foreign branches and subsidiaries are translated in the market rate at

the balance sheet date and shareholders’ equity is translated in the market rate at the

creation date (historical rates). Profit and loss items are translated in the market at

the transaction date. The difference arisen from translation of the balance sheets of

foreign branches and subsidiaries is posted in the shareholders’ equity.

Depreciation Method

Depreciation rate

Assets

Premises

Automobiles

Equipment & computer

hardware systems

PC hardware

7%

25%

10 years

10 years

Notes to the Financial Statements

59

3-6- Provisions for Doubtful Debts

According to the resolution adopted in 1074th on 30.12.2006 and 1077

th

dated

17.02.2007 session of the Money & Credit Council, provisions for doubtful debts are

calculated and posted in the books as follows:

3-6-1- General provisions are calculated equal to 1.5% of the balance of total loans,

except those for which specific provisions have been made.

3-6-2- Specific provisions: are calculated and charged to the accountspro-

portionate to the category of the over due loans and thereafter that they lose

collateral coverage as follows:

3-7- Severance Pay Reserve

The reserve for the staffs’ severance pay is calculated as one- month of their last

salary and benefits for each year of service and considered in the accounts.

3-8- Assets classification

According to the resolution adopted in 1074

th

and 1077

th

session of the Money &

Credit Council, loans granted by the bank are classified based on the delay period,

customer’s solvency, and the situation of the customer’s industry as follows:

1- Outstanding

2- Overdue

3- Non performing

4- Doubtful

3-9- Severance Pay Liabilities

The present value of the staffs’ severance pay liabilities with respect to their years

of service (including, working, retired and pensioner staff) are calculated based on

actuary assumptions.

3-10- Dues from the Government

The mandatory facilities granted under former Management & Planning Organization

of the state, are regarded as dues from the government under following conditions:

a- Non performing loans due to customer’s insolvency, inadequate collaterals, or

failure of the bank in collecting the debt;

b- The overdue loans relating to performing acquiring capital assets;

c- Loans granted to ministries and government organizations.

Category

Overdue loans

Non performing loans

Doubtful loans, given assessing customer’s solvency

Loans that 5 years or more has passed from their maturity

Provisions

10 %

20 %

50-100 %

100 %

60

Notes to the Financial Statements

7) Dues from the Central Bank

1387 (2008/09)

1386 (2007/08)

Deposit with the Central Bank

Prepayment for purchasing foreign currency

Total

41,499,478

2,205

41,501,683

37,747,491

2,205

37,749,696

8) Dues from Banks & Credit Institutes

1387 (2008/09)

1387 (2008/09)

1386 (2007/08)

1386 (2007/08)

Up to 6 months

Up to one year

One to 5 years

Over 5 years

Total

Deduction:

Provisions for doubtful debts

Profit of the following years

Total

17,593,867

12,610,716

14,095,473

4,221,363

48,521,419

(44,345)

(13,267)

48,463,807

10,671,561

7,649,031

8,549,610

2,560,468

29,430,670

(19,086)

(18,548)

29,393,036

10) Loans & Advances to the Public Sector

Governmental Sector

1 to 3 years

3 to 5 years

5 to 10 years

Over 10 years

Total

Deduction:

Provisions for over due & doubtful debts

General provisions

Profit for the following years

Differed profit

Total

4,646,043

1,334,012

3,340,393

1,403,125

10,723,573

(18,431)

(144,918)

(16,961)

10,447,263

6,539,082

1,875,632

4,696,620

1,966,097

15,077,431

(162,298)

(319,258)

(15,043)

14,580,832

61

11&12) Loans & Advances to other parties

1387 (2008/09)

1386 (2007/08)

1 to 3 years

3 to 5 years

5 to 10 years

Over 10 years

Total

Deduction:

Reserve for doubtful & differed loans

general reserve

general reserve

Contingent profit for the following years

Differed profit

Total

166,657,096

67,833,796

20,505,359

16,129,144

271,125,395

(3,087,310)

(17,440,169)

(21,149,316)

(2,452,775)

226,995,825

150,934,852

61,434,431

18,570,906

14,607,539

245,547,728

(3,566,900)

(11,863,918)

(21,085,028)

(452,230)

208,579,652

14) Participation Bonds & the Like

1387 (2008/09)

1386 (2007/08)

Participation Bonds(1 year)

Foreign currency Bonds

Total

1,917,673

476,831

2,394,504

1,857,019

526,985

2,384,004

15) Investments & Partnerships

1387 (2008/09)

1386 (2007/08)

Domestic investments

foreign Investments

Total

Deduction:

provisions for impairment of stock

2% general provisions

Total

2,231,966

2,143,165

4,375,131

(79,721)

-----------

4,295,410

1,933,790

1,466,734

3,400,524

(34,721)

-----------

3,365,803

17) Other Assets

1387 (2008/09)

1386 (2007/08)

Accounts & receivable shares profit

Banks internal accounts

Tax prepayment

Prepayments to companies & institutions

Total

57,294

2,334,142

316,130

1,208,087

3,915,653

32,118

1,913,146

209,225

549,853

2,704,342

62

Notes to the Financial Statements

19) Dues to the Central Bank

1387 (2008/09)

1386 (2007/08)

Imprest governmental funds (Central Bank)

Facilities received from Central Bank

Other dues

Deduction:

Dues from the Central Bank

Total

0

21,596,912

1,127,404

(131,926)

22,592,390

3,004,067

1,332,240

3,635,554

(154,211)

7,817,650

20) Dues to Banks & Credit Institutions

1387 (2008/09)

1386 (2007/08)

Banks’ vostro non-interest bearing current account

Non-banks’ non-interest bearing current account

Sight foreign currency deposits of Iranian &foreign banks

Refinance facilities received

Facilities received under oil stabilization fund

Other

Total

170,109

1,923,162

2,830,485

1,435,164

11,947,072

10,973,676

29,279,668

168,465

1,285,533

865,424

3,534,803

12,016,312

11,410,362

29,280,899

25&26) Provisions & Other Liabilities

1387 (2008/09)

1386 (2007/08)

Tax provition

Deficit in profit paid to depositors

Other provitions and liabilities

Total

2,549,094

10,161

6,702,129

9,261,384

433,457

9,445

5,006,022

5,448,924

34&35&38&39) Profit & Commissions Received

1387 (2008/09)

1386 (2007/08)

Profit of legal reserves held with the Central Bank

Profit of participation bonds and the like

Profit received from banks

Profit received from customers

Commissions received

Total

316,877

593,742

---

29,688,113

2,441,222

33,130,905

296,090

385,007

276,873

23,749,631

2,127,831

26,835,432

36&41&43) Profit & Commissions Paid

1387 (2008/09)

1386 (2007/08)

Profit paid to banks

Profit paid to time deposits

Commissions paid

Total

1,612,346

17,525,365

266,484

19,404,195

952,444

12,442,367

153,989

13,548,800

63

Assets:

Comparing year-end balance of assets in 2007/08 versus 2007/08

Having experienced an increase of 38,087 billion Rials over 1386(2007/08),

the balance of the assets amounted to 422,678 billion (9.9 % growth) at the

end of 1387(2008/09), compared to 384,591 billion Rials of 1386(2007/08).

The major increase and decrease was respectively due to increase in items

such as dues from other Banks and financial institutions amounting to 19,071

billion Rials and loans and advances to other parties amounting to 18,416 billion

and decrease in chapters such as granted facilities and loans & advances to the

public sector amounting to 4,134 billion Rials.

Noteable items in the assets:

• Growth in the balance of the time deposits held with the central bank of the

I.R. of Iran from 2,213 to 7,222 billion Rials;

• 82 % Growth in foreign currency time deposits held with Iranian and foreign

banks;

• 47 % decrease in the balance of the granted facilities and loans & advances

to the public sector mostly related to installment purchase contracts (mandatory

or else) from 3,282 to 1,649 billion Rials and civil partnership contracts from

2,755 to 728 billion Rials;

• New investment in Mehr-Iran Gharz-ol-hasaneh Bank’s shares.

Liabilities and shareholders equity:

Having enjoyed a growth by 9.9 %, the balance of Liabilities and

shareholders equity amounted to 422,678 billionat the end of 1387(2008/09),

compared to 384,591 billion Rials of 1386(2007/08). The major increase and

decrease was respectively because of 27,312 billion Rials increase in time

investment deposits and 16,299 billion Rials decrease in the sight deposits.

Noteable items in the Liabilities and shareholders equity:

• Increase in facilities received from the CBI by 20,265 billion Rials (for the

credit lines received from the CBI);

• 49.5% growth in the balance of non-interest bearing current account of

non-bank credit institutions;

• 267.9% growth in the balance of foreign currency sight deposits of the

Iranian banks;

• 55.5% growth in the balance of long term investment deposits;

• 73.4% growth in the balance of special short term investment deposits;

• 31% growth in the capital adequacy ratio of the bank from 7.24% in

1386(2007/08) to 9.48 % in 1387(2008/09).

Balance sheet Analysis as at March 20

th

2009

64

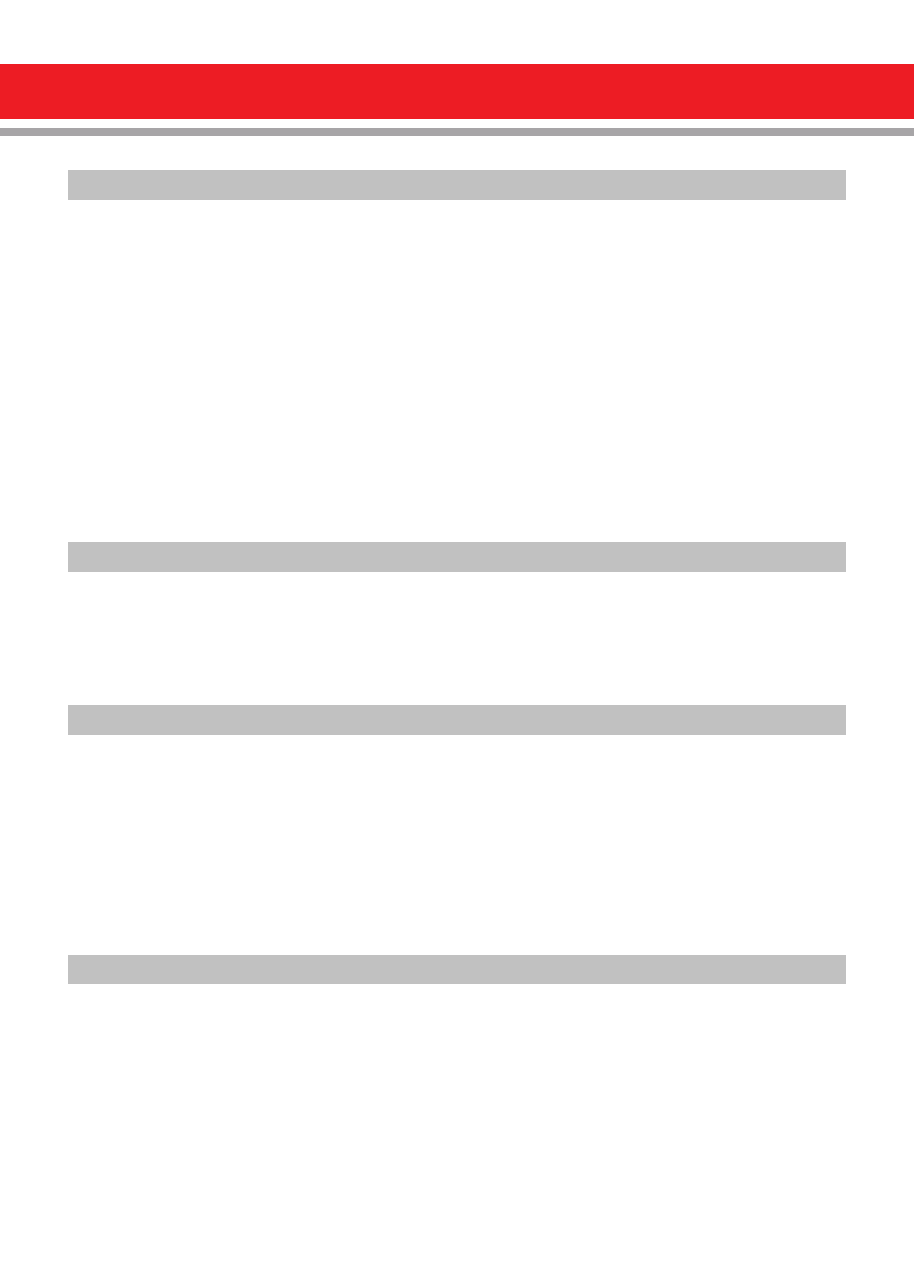

A) Rate of Return on Facilities

Bank joint incomes comprising figures out of Islamic-based contracts, Investments, Legal

Participation, Participation Bonds, and the incomes yielded from legal reserves, amounted to 25,525

Billion Rials at the end of 1387(2008/09), representing a growth by 29% over the previous year.

What has been observed, however, is that there was a 15 % growth in facilities volume in 1387

(2008/09) over 1386(2007/08) resulting in 12 % growth in rate of return at the end of 1387(2008/09)

compared to that of 1386(2007/08); part of which can be attributable to the increase in the profit

rate of granted facilities across economic sectors as well as a change in the bank's vision in granting

more joint-venture facilities, which leaves banks hands more open in setting the profit rate, rather

than commercial loans.

B) Profit paid to the depositors

Profit paid to the depositors on an on account basis at the end of 1387(2008/09) amounted to

15,873 billion Rials, representing a growth by 44 % compared to that of 1386(2007/08). The Reason

for such increase can be sought in increasing deposits and the facilities rate of returns. As shown in

below table, the growth rate for Investment deposits in 1387(2008/09) compared to the previous

year has been more than 25%. Rate of return on facilities has also experienced an acceptable growth

in 1387(2008/09) compared to 1386(2007/08).

C) Deficit(surplus) in payment to the investors

At the end of 1387(2008/09) the bank faced with payments deficit amounting to 166 billion

Rials which was due to the high rate of return on facilities compared to 1386(2007/08); while it

faced with payments surplus amounting to 159 billion Rials at the end of 1386(2007/08) which could

Profit and Loss Analysis

March 20

th

2009

March 20

th

2009

March 20

th

2008

March 20

th

2008

change

Joint income

Average income of the facilities,

Investments & Participation Bonds

Rate of return

Total investment deposits

126,681

100,944 25.5 %

25,525

173,194

14.7 %

19,777

150,609

13.1 %

Rate of return on facilities, investments & Participation Bonds

(In billion Rials)

Total investment deposits

(In Billion Rials)

65

be because of the low rate of return on facilities. It is noteworthy that the low rate of return on

facilities in 1386(2007/08) was due to the low rate of return on facilities in Banks in that year which

was modified by the banks’ shifting vision in granting facilities under joint-venture contract rather

than commercial ones.

D) Income derived from the bank’s own resources

This income was mainly derived from commissions, foreign operations, stocks, foreign bonds,

delayed payment charges received out of letters of credit delayed settlement, letters of guarantees,

and translation of foreign currency-based assets and liabilities. The aforesaid income amounted to

10,930 billion Rials at the end of 1387(2008/09) which has experienced a growth by 46.7 % over

1386(2007/08) that was 7,449 billion Rials. The consequences of the changes are as follows:

• Income gained from translation of the foreign currency-based assets and liabilities in 1387(2008/09)

amounted to 2,424 billion Rials, having resulted from translation of foreign currency accounts that

caused s considerable increase in the income derived from the bank’s own resources.

• The bank’s Policy in rendering various types of services to the customers has resulted in gaining

a considerable income as services commissions. So that, received commission experienced a growth

by 15% in 1387(2008/09) over 1386(2007/08).

E) Non-operational expenses

At the end of 1387(2008/09) the bank faced with payments deficit amounting to 166 billion

Rials which was due to the high rate of return on facilities compared to 1386(2007/08); while it

faced with payments surplus amounting to 159 billion Rials at the end of 1386(2007/08) which could

be because of the low rate of return on facilities. It is noteworthy that the low rate of return on

facilities in 1386(2007/08) was due to the low rate of return on facilities in Banks in that year which

was modified by the banks’ shifting vision in granting facilities under joint-venture contract rather

than commercial ones.

F) Cash profit before tax deduction

Having experienced an increase of 1,067 billion Rials, cash profit of the bank before tax deduction

amounted to 3,586 billion Rials in 1387(2008/09), showing a growth by 42% over 1386(2007/08).

This increase in the bank’s profit compared to the previous year can mainly be contributed to

increase in the facilities profit in joint-venture contracts, rendering more qualitative and diversified

services, receiving more commissions and also incorporating translation of foreign currency based

assets and liabilities in the bank’s income.

March 20

th

2009

March 20

th

2008

change

Total Revenues

Total Expenses

36,454

32,868

27,226

24,707

33.9 %

33 %

Total revenues versus total expenses

(In Billion Rials)

Wyszukiwarka

Podobne podstrony:

notes to the witness statement

Consolidated Financial Statements of the Group & Bank Mellat

Application Of Multi Agent Games To The Prediction Of Financial Time Series

The Independent Filmmakers Guide To Film Financing

Index to the Grammar Notes

Intro to the Finite Element Method [lecture notes] Y Liu (1998) WW

Guide to the properties and uses of detergents in biology and biochemistry

Bo Strath A European Identity to the historical limits of the concept

A Guide to the Law and Courts in the Empire

FreeNRG Notes from the edge of the dance floor

An Introduction to the Kabalah

5A,[ To the top 3

dos passos rosinante to the road again

19 Trauma to the Spine

excercise1 Many Italians immigrated to the United States and?nada

a sociological approach to the simpsons YXTVFI5XHAYBAWC2R7Z7O2YN5GAHA4SQLX3ICYY

więcej podobnych podstron